For those of you Buyers who’ve been in the market a long time for a home, who are annoyed at the low inventory and the lofty price tags attached to homes, may find it hard to believe that this sellers market could be nudging in any direction, particularly to your advantage, but what I am seeing shows some cracks in this sellers market.

For those of you Buyers who’ve been in the market a long time for a home, who are annoyed at the low inventory and the lofty price tags attached to homes, may find it hard to believe that this sellers market could be nudging in any direction, particularly to your advantage, but what I am seeing shows some cracks in this sellers market.

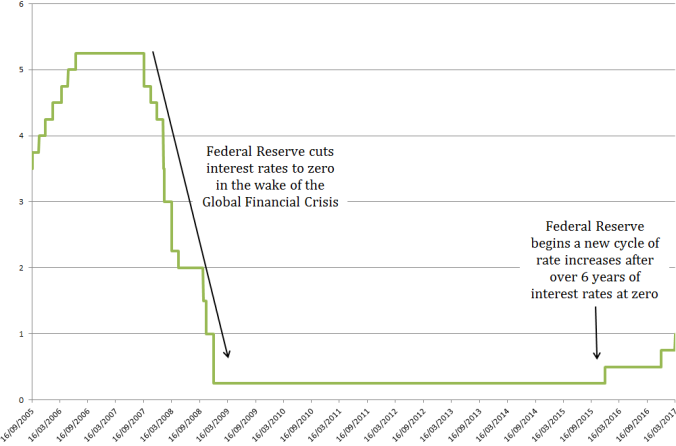

So you don’t have to put all your trust in this one agent who has seen homes sitting a little longer on the market and noted less homes selling for asking price, the Federal Reserve’s monetary policy committee raised rates a .25% last March and have planned to raise them two more times in 2017. This will put mortgage rates at a whole 1% higher than it was a year ago by November which has an impact on what borrower’s can afford to pay. Often people do not take into account who really sets the prices on the market. It is not the sellers agent or broker. It is not the sellers either. It is those who are bring the money to the table to buy that home–the buyers. If the buyers cannot qualify for a loan to purchase a house, then that house will not sell at “that” price. The higher rates will eventually have an impact on what homes may sell for.

So you don’t have to put all your trust in this one agent who has seen homes sitting a little longer on the market and noted less homes selling for asking price, the Federal Reserve’s monetary policy committee raised rates a .25% last March and have planned to raise them two more times in 2017. This will put mortgage rates at a whole 1% higher than it was a year ago by November which has an impact on what borrower’s can afford to pay. Often people do not take into account who really sets the prices on the market. It is not the sellers agent or broker. It is not the sellers either. It is those who are bring the money to the table to buy that home–the buyers. If the buyers cannot qualify for a loan to purchase a house, then that house will not sell at “that” price. The higher rates will eventually have an impact on what homes may sell for.

Another aspect to consider is renting v. buying. The Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, is an index that analyzes whether the current housing market is one that is better to rent in or buy in. The BH&J looks at the US housing market as a whole while also focusing on 23 major cities to compare markets across the nation, and the numbers have continued to move closer to a buyers territory. The index shows in some markets estimates where renting will top home ownership in 7 out of 10 markets.

These two factors are the first cracks to show in this solid sellers market. One more is more my personal opinion so take from it what you wish. I have also noticed that mortgage requirements are easing. For instance, the Mortgage Bankers Association tracks the availability of mortgage credit through the Mortgage Credit Availability Index (MCAI), and this index has been trending upwards. Last September it was hovering around 167 and last month around 183. Personally, I believe in identifying patterns to know what is coming next and one pattern I’ve noticed with banks is they loosen credit requirements when the market is trending towards its top, right before it tips the scales in the other direction.

All this said, I wouldn’t go kicking your heels up just yet if you’re a buyer or feeling down in the dumps if you’re a seller. The housing market is notoriously slow in responding to the economic indicators that surround it. I would though consider it cause for getting off the fence if you are considering selling or buying now to avoid paying higher rent and to get ahead of those rate hikes that will leave you perpetually paying a higher interest rate on your mortgage.

217 S. Main St., Moscow

O: 208.882.0800

C: 208.892.9256